Our Clark Wealth Partners Statements

Wiki Article

The Ultimate Guide To Clark Wealth Partners

Table of ContentsMore About Clark Wealth PartnersThe 10-Minute Rule for Clark Wealth PartnersThe Basic Principles Of Clark Wealth Partners Some Known Details About Clark Wealth Partners Clark Wealth Partners - An OverviewThe Best Guide To Clark Wealth PartnersUnknown Facts About Clark Wealth Partners

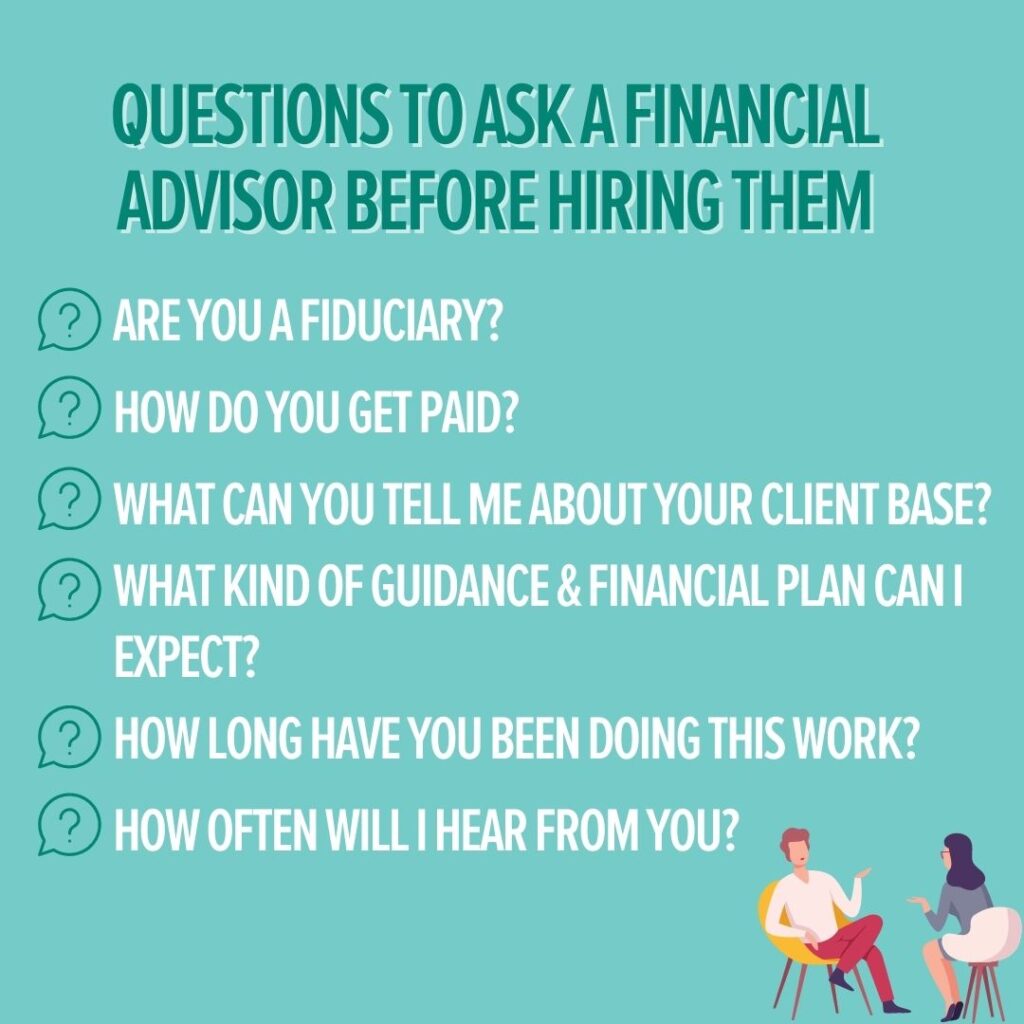

These are professionals who offer financial investment advice and are registered with the SEC or their state's safety and securities regulator. NSSAs can aid elders make decisions regarding their Social Safety and security advantages. Financial advisors can likewise specialize, such as in trainee car loans, elderly requirements, tax obligations, insurance policy and various other elements of your finances. The certifications needed for these specialties can differ.Just monetary advisors whose designation calls for a fiduciary dutylike licensed financial organizers, for instancecan state the exact same. This distinction additionally implies that fiduciary and economic consultant cost structures differ as well.

An Unbiased View of Clark Wealth Partners

If they are fee-only, they're much more likely to be a fiduciary. Lots of credentials and classifications need a fiduciary task.

Selecting a fiduciary will certainly guarantee you aren't steered towards specific financial investments as a result of the payment they supply - retirement planning scott afb il. With lots of cash on the line, you might desire a monetary professional who is lawfully bound to utilize those funds meticulously and just in your finest rate of interests. Non-fiduciaries might advise financial investment items that are best for their wallets and not your investing goals

About Clark Wealth Partners

Find out more now on just how to maintain your life and savings in equilibrium. Boost in cost savings the average house saw that dealt with a financial expert for 15 years or more contrasted to a similar household without an economic consultant. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "A lot more on the Value of Financial Advisors," CIRANO Task Reports 2020rp-04, CIRANO.

Financial recommendations can be useful at turning factors in your life. When you fulfill with an adviser for the very first time, function out what you desire to get from the guidance.

Everything about Clark Wealth Partners

As soon as you have actually concurred to go ahead, your monetary adviser will prepare an economic strategy for you. You must always feel comfy with your consultant and their recommendations.Firmly insist that you are notified of all transactions, which you get all communication related to the account. Your consultant might suggest a managed optional account (MDA) as a method of managing your financial investments. This includes signing an agreement (MDA agreement) so they can purchase or sell financial investments without having to contact you.

Not known Details About Clark Wealth Partners

To safeguard your cash: Do not give your advisor power of lawyer. Urge all correspondence regarding your financial investments are sent out to you, not just your adviser.This might take place throughout the meeting or digitally. When you go into or restore the recurring fee plan with your advisor, they need to describe exactly how to end your relationship with them. If you're moving to a brand-new consultant, you'll require to set up to move your monetary records to them. If you need help, ask your consultant to clarify the process.

will retire over the next decade. To load their footwear, the country will need greater than 100,000 brand-new monetary consultants to enter the industry. In their everyday job, monetary advisors manage both technological and creative jobs. U.S. Information and Globe Report ranked the duty amongst the top 20 Best Organization Jobs.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Helping people accomplish their economic objectives is a financial expert's primary function. Yet they are additionally a local business owner, and a part of their time is committed to managing their branch workplace. As the leader of have a peek at this site their technique, Edward Jones financial consultants require the management skills to employ and take care of staff, in addition to the organization acumen to create and perform a service approach.Financial experts invest a long time on a daily basis watching or reviewing market information on television, online, or in trade magazines. Financial experts with Edward Jones have the benefit of office research teams that assist them stay up to day on supply referrals, common fund management, and more. Investing is not a "set it and forget it" activity.

Financial advisors need to set up time each week to meet new individuals and capture up with the individuals in their sphere. Edward Jones financial advisors are fortunate the home office does the heavy lifting for them.

The Best Guide To Clark Wealth Partners

Edward Jones economic consultants are encouraged to go after additional training to expand their knowledge and abilities. It's also a great idea for monetary experts to go to sector seminars.Report this wiki page